American Airlines Ramps Up Charlotte-Miami Flights Following Frontier’s Entrance

American Airlines is well-known for retaliating against other airlines that add new flights to American’s hubs.

Years ago, Icelandic airlines WOW Air and Icelandair announced their entrance into American’s Dallas/Fort Worth (DFW) hub with flights from Reykjavik (KEF). American soon responded by launching its own DFW-KEF route. Eventually, WOW Air exited the market, followed by Icelandair, and later American.

More recently, Breeze Airways announced it would begin flying from Provo (PVU) to Dallas/Fort Worth (DFW). Weeks later, American announced it would also begin flying the PVU-DFW route.

Over the last several months, ultra low-cost carrier Frontier Airlines has been reshaping its network, entering a multitude of routes that overlap with American. Unsurprisingly, American quickly responded by adding capacity to those routes. Just a few days ago, Frontier announced a new 3 times per week Charlotte (CLT) to Miami (MIA) route, a flight that’s between two of American’s southeast hubs.

Now American appears to have responded once again, with plans to increase its own CLT-MIA route from 8 daily to 11 daily flights starting in October. Although Frontier’s CLT-MIA route starts three months prior, American likely doesn’t have the flexibility to add additional capacity so soon.

American ramping up CLT-MIA from 8 to 11 daily flights might seem like an aggressive move, but market data may show the reason for American’s assertion. A post from Enilria showed American had lost a significant amount of market share for local passengers flying between CLT and MIA year-over-year.

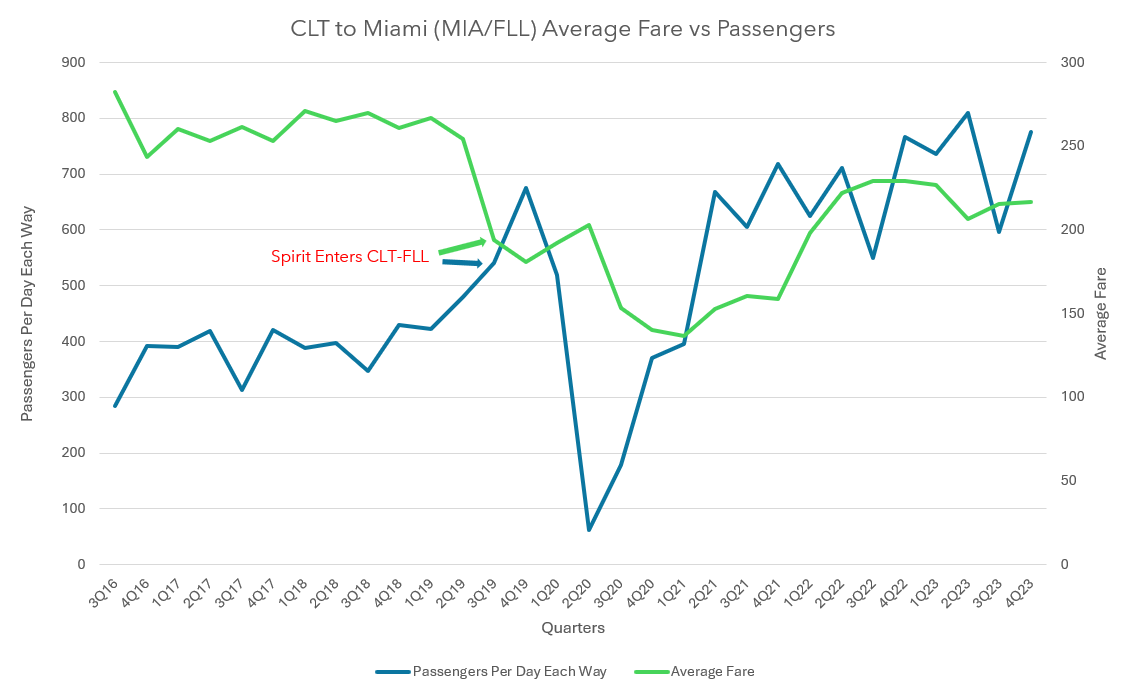

I decided to look more into the Department of Transportation’s (DOT) past data for the Charlotte to Miami Area market (encompassing both MIA and Fort Lauderdale Airports) as shown below:

Spirit Airlines, another ultra low-cost carrier, began flying from Charlotte to the Miami Area (through Fort Lauderdale’s airport) in the middle of 2019. At that time, American had a 90% market share for passengers traveling solely between Charlotte and the Miami Area. That share remained stable through 2021. Then Spirit started to add more capacity and eventually launched its own CLT-MIA route at the end of 2022. Spirit’s market share continued to soar to around 40% while American fell towards 60%.

The number of local passengers flying between Charlotte and the Miami Area has nearly doubled over the past five years. The average fare fell as Spirit entered while passenger numbers continued to rise (excluding 2020 with COVID).

The data shows very basic economic dynamics. As the carrier with lower fares (Spirit) enters the market, they stimulate demand, attracting price-conscious customers. The incumbent carrier (American) may respond, such as through additional capacity or lower fares. The data suggests American certainly did the latter in 2019, with its average fares decreasing by 20% when Spirit entered.

This clearly shows how low-cost carriers can affect the market, especially when they gain a greater share of passengers. The overall market fare for CLT-Miami remained aligned with American’s average fare until Spirit’s market share rose, leading to the average fare to diverge away from American’s fare.

American’s fare did rise in 2022, which could have been the airline aiming to improve yields and/or placing less of a focus on the local CLT-Miami market. But during that time, Spirit managed to drastically increase its share of the local market.

With all of this, it’s possible American feels threatened by Frontier’s entrance into CLT-MIA, which has the potential to further degrade American’s market share. Despite Frontier’s service only operating 3 flights per week, American is throwing in an additional 21 flights per week. Since this route is between two American hubs with large loyalty bases, the carrier likely intends to ensure it won’t lose customers to its competitors.

American does have the ability to offer a significant amount of connections through Charlotte or Miami, but all of this additional capacity will likely place pressure on airlines’ yields for the local market.