Frontier Airlines Fades Away In Austin With One Route Remaining

Austin-Bergstrom International Airport (AUS) has seen an abundance of new air service over the last few years, growing daily departures and seat capacity by nearly 40% compared to 2019 levels alongside adding nearly 30 new nonstop destinations.

The majority of this capacity growth comes from American Airlines, which has added over 35 new routes from Austin since 2019, and Southwest Airlines. Other U.S. carriers, such as Alaska Airlines, Allegiant Air, and Delta Air Lines, have also expanded capacity in Austin.

While other airlines have grown, Frontier Airlines has significantly decreased its presence in Austin. In 2018, Frontier offered 30 nonstop routes out the city. Today, the airline serves just two routes from Austin—nonstop to Denver (DEN) and Las Vegas (LAS). However, Jamy Kazanoff, who manages the airport’s air service, confirmed during the latest Airport Advisory Commission meeting that Frontier will drop its Las Vegas route. The carrier’s final Austin—Las Vegas flight is scheduled for November 13.

With Las Vegas ending, Frontier will only offer one route from Austin this winter with just 3x weekly service to Denver.

Frontier Airlines’ Austin presence already began to decline in 2019 versus the previous year, but the pandemic exacerbated the reductions from 2020 onward. While other airlines rapidly restored Austin capacity and surpassed 2019 levels, Frontier Airlines continued to pull down its Austin network and lose market share.

Data collected from monthly AUS Airport Activity Reports

Between 2018 and 2023, Frontier Airlines’ Austin network declined from 30 routes to only one route. This is reflected in their passenger statistics as well, from serving 133,728 Austin passengers in June 2018 to just 8,435 in June 2023—a 93.69% decrease over five years. Frontier held a 9% market share in summer 2018, but now only has a 0.42% share as of June 2023. Although this is not a representation of Frontier’s available seats (I lack this data), it conveys a comparable trend.

The graph illustrates Frontier’s seasonal variation in Austin with peak passengers in the summer and troughs in the winter. 2019 passengers decreased from 2018, likely as a result of Frontier pulling back capacity and ending several routes that underperformed in the previous summer.

When COVID-19 impacted the industry in March 2020, all carriers simultaneously withdrew capacity, allowing Frontier to maintain a relatively stable Austin market share for most of the year. However, as demand recovered in 2021, Frontier opted not to restore the majority of its pre-pandemic Austin network and chose to focus on a few core routes. Competition intensified, which may have deterred Frontier from expanding. Other airlines continued to ramp up capacity, resulting in Frontier’s market share to gradually decline.

With just 3x weekly flights to Denver and the Las Vegas route ending, Frontier’s fall in passengers and market share will persist. Although Frontier offers connections—with its Denver hub offering the largest number of routes—the airline’s AUS-DEN flight arrives after 9:00 PM, limiting the amount of potential connections without an overnight stay in Denver.

Frontier’s weakness in Central Texas isn’t limited to Austin. Over in San Antonio (SAT), Frontier offered 23 nonstop routes in 2018. Today, their SAT network comprises of only four routes.

Other U.S. Airlines’ Austin Passenger Numbers

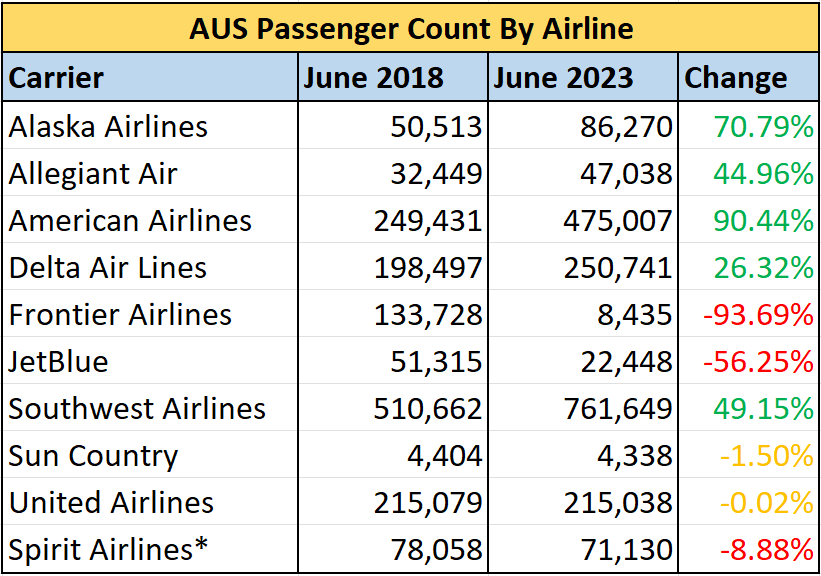

As a comparison against Frontier’s 93.69% decrease in Austin passengers, here’s passenger data comparing June 2018 and June 2023 for the other U.S. airlines.

Data collected from monthly AUS Airport Activity Reports

*Spirit entered AUS in early 2019. Spirit compares June 2019 VS June 2023.

American Airlines has nearly doubled its number of Austin passengers over five years. Southwest Airlines, Alaska Airlines, Allegiant Air, and Delta Air Lines have grown considerably.

United Airlines and Sun Country remain stagnant while Spirit Airlines has slightly declined. JetBlue only carried half of its 2018 passengers, likely attributed to a decrease in capacity, such as ending its Long Beach (LGB) and Orlando (MCO) routes.

Austin continues to set passenger records, exceeding two million monthly passengers in both June and July 2023. As the airport becomes more restricted without access to additional gates, the number of incremental flights will slow down, and capacity growth will come in the form of larger aircraft.

Austin is set to undergo a major terminal expansion over the next decade. However, this includes demolishing the South Terminal, which Frontier currently operates from. It’s unclear how this will affect Frontier and if it forces them to make additional changes to their Austin network due to varying costs.

It’ll be interesting to see Frontier’s future in the region and if just a few flights a week to Denver is enough to keep the airline in Austin.